UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

|

| | | | |

| | | | |

¨ | | Preliminary Proxy Statement |

| |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

x | | Definitive Proxy Statement |

| |

¨ | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

Yext, Inc. |

(Name of Registrant as Specified in Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

| |

x | | No fee required. |

| |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1. | | Title of each class of securities to which transaction applies: |

| | | | |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fees is calculated and state how it was determined): |

| | | | |

| | 4. | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5. | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1. | | Amount Previously Paid: |

| | | | |

| | 2. | | Form, Schedule or Registration Statement No.: |

| | | | |

| | 3. | | Filing Party: |

| | | | |

| | 4. | | Date Filed: |

| | | | |

April 26, 2019

Fellow Stockholders:

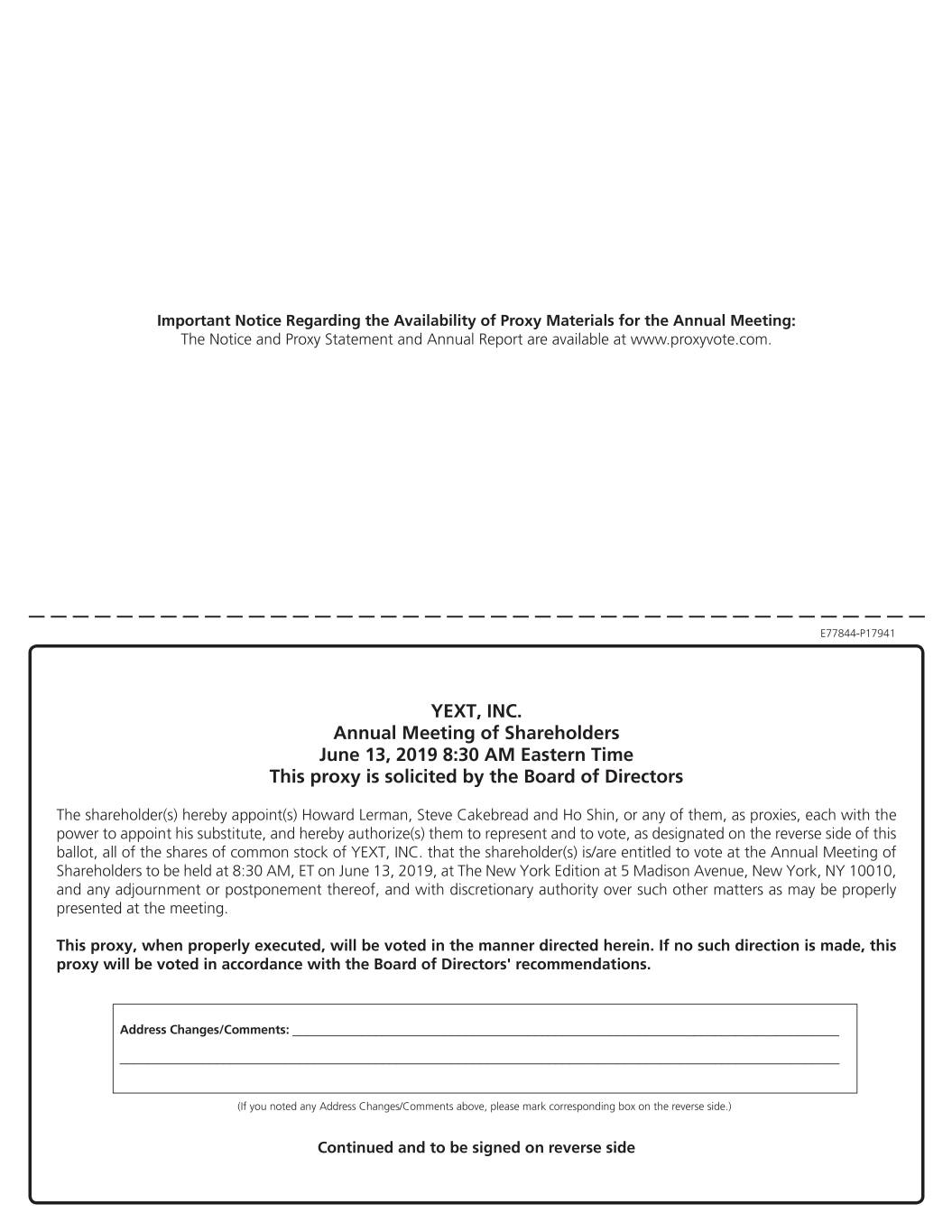

We are pleased to invite you to attend the 2019 Annual Meeting of Stockholders of Yext, Inc. (the "Annual Meeting") to be held on June 13, 2019 at 8:30 a.m. Eastern Time, at The New York Edition at 5 Madison Avenue, New York, New York 10010. Details regarding admission to the Annual Meeting and the business to be conducted are more fully described in the accompanying Notice of Annual Meeting of Stockholders and proxy statement.

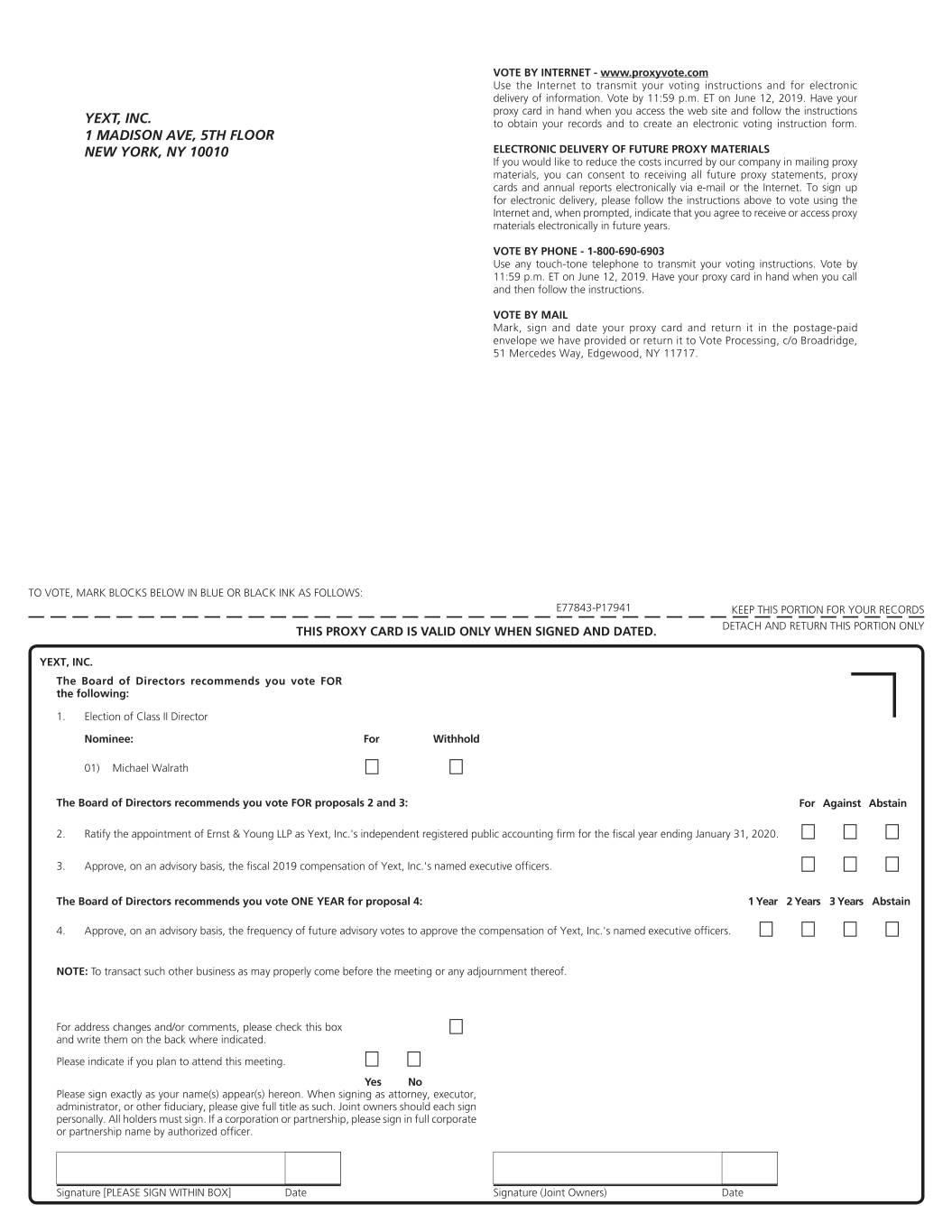

At this year’s meeting, we will vote on the election of Michael Walrath as a Class II director and the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm. We will also conduct non-binding advisory votes to approve the fiscal 2019 compensation of our named executive officers and to establish the frequency of such future advisory votes. Finally, we will transact such other business as may properly come before the meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet or by telephone or, if you requested printed copies of the proxy materials, by mailing a proxy or voting instruction card. Voting over the Internet, by telephone or by written proxy will ensure your representation at the Annual Meeting regardless of whether you attend in person. Please review the instructions on the proxy or voting instruction card regarding each of these voting options.

We are pleased to furnish proxy materials to stockholders primarily over the Internet. This process expedites stockholders’ receipt of proxy materials, while lowering the costs of our Annual Meeting and conserving natural resources. On or around April 26, 2019, we will mail our stockholders a notice containing instructions on how to access our proxy materials including our Annual Report for the fiscal year ended January 31, 2019 (the "Annual Report"). The notice also provides instructions on how to vote online, by phone or by mail, and includes instructions on how you can receive a paper copy of proxy materials by mail.

Thank you for your ongoing support of and continued interest in Yext.

Sincerely,

Howard Lerman

Chief Executive Officer

YEXT, INC.

1 Madison Avenue, 5th Floor

New York, New York 10010

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

June 13, 2019

|

| | |

| | |

Time and Date | | 8:30 a.m. Eastern Time on June 13, 2019 |

Place | | The New York Edition at 5 Madison Avenue, New York, New York 10010 |

Items of Business | | 1. To elect Michael Walrath as a Class II director to hold office until our Annual Meeting of Stockholders in 2022 and until his successor has been elected or appointed; 2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2020; 3. To approve, on an advisory basis, the fiscal 2019 compensation of our named executive officers; 4. To hold an advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officers; and 5. To transact any other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

Adjournments and Postponements | | Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed.

|

Record Date | | You are entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement that may take place only if you were a stockholder as of the close of business on April 18, 2019. |

Proxy Materials | |

We are pleased to take advantage of Securities and Exchange Commission rules that allow us to furnish the proxy statement for our Annual Meeting and our annual report for the fiscal year ended January 31, 2019 (together, the "proxy materials") to stockholders on the Internet. On or around April 26, 2019, we will mail stockholders entitled to vote at the Annual Meeting a notice containing instructions on how to access these proxy materials. The proxy materials may also be accessed directly via the Internet at www.proxyvote.com using the control number located on your notice or proxy card. |

Voting | |

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. You may vote over the Internet or by telephone. In addition, if you requested printed copies of the proxy materials, you may submit your proxy or voting instruction card for the Annual Meeting by completing, signing, dating and returning your proxy or voting instruction card in the pre-addressed envelope provided. For specific instructions on how to vote your shares, please refer to the section entitled “Questions and Answers” beginning on page 1 of this proxy statement and the instructions on the proxy or voting instruction card. You can revoke a proxy prior to its exercise at the Annual Meeting by following the instructions in the accompanying proxy statement.

|

By order of the Board of Directors,

Ho Shin

General Counsel & Corporate Secretary

TABLE OF CONTENTS

|

| |

| Page |

Proxy Statement Questions and Answers | |

Directors and Corporate Governance | |

Board Composition | |

Director Independence | |

Board Leadership | |

Board Committees and Meetings | |

Identifying and Evaluating Director Nominees | |

Risk Oversight | |

Compensation Risk Assessment | |

Communications with Directors | |

Code of Business Conduct and Ethics | |

Corporate Governance Guidelines | |

Compensation Committee Interlocks | |

Compensation of Non-Employee Directors | |

Outside Director Compensation Policy | |

Executive Officers | |

Executive Compensation | |

Compensation Discussion and Analysis | |

Executive Summary | |

Executive Compensation Philosophy, Objectives, and Design | |

Compensation-Setting Process | |

Use of Competitive Data | |

Executive Compensation Program Components | |

Tax and Accounting Considerations | |

Compensation Committee Report | |

Summary Compensation Table | |

Grants of Plan-Based Awards | |

Outstanding Equity Awards | |

Option Exercises and Stock Vested | |

401(k) Plan | |

Pension Benefits | |

Non-Qualified Deferred Compensation | |

Named Executive Officer Employment Arrangements | |

Potential Payments Upon Termination or Change in Control | |

Indemnification | |

Beneficial Ownership of Shares of Common Stock | |

Section 16(a) Beneficial Ownership Reporting Compliance | |

Certain Relationships and Related Person Transactions | |

Policies and Procedures for Transactions with Related Persons | |

Transactions and Relationships with Directors, Officers and 5% Stockholders | |

Proposals Requiring Your Vote - Item 1 - Election of a Class II Director | |

Proposals Requiring Your Vote - Item 2 - Ratification of Independent Registered Public Accounting Firm | |

Proposals Requiring Your Vote - Item 3 - Advisory Vote to Approve the Fiscal 2019 Compensation of our Named Executive Officers | |

Proposals Requiring Your Vote - Item 4 - Advisory Vote on the Frequency of Future Advisory Votes to Approve Named Executive Officer Compensation | |

Transaction of Other Business | |

|

| |

Requirements, Including Deadlines, for Submission of Proxy Proposals, Nomination of Directors and Other Business of Stockholders | |

Appendix A | |

YEXT, INC.

1 Madison Avenue, 5th Floor

NEW YORK, NEW YORK 10010

PROXY STATEMENT QUESTIONS AND ANSWERS

The information provided in the “Questions and Answers” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read the entire proxy statement carefully.

Why am I receiving these proxy materials?

You are receiving these proxy materials from us because you were a stockholder of record at the close of business on April 18, 2019 (the “Record Date”). The Board of Directors of Yext, Inc., a Delaware corporation (“Yext,” the “Company,” “we,” “us,” or “our”), has made these proxy materials available to you on the Internet or, upon your request, by delivering printed versions of these materials to you by mail, in connection with our solicitation of proxies for use at our 2019 Annual Meeting of Stockholders (the “Annual Meeting”) which will take place on June 13, 2019 at 8:30 a.m. Eastern Time, at The New York Edition at 5 Madison Avenue, New York, New York 10010.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of printed proxy materials?

Pursuant to the “notice and access” rules adopted by the Securities and Exchange Commission, we have elected to provide stockholders access to our proxy materials over the Internet. Accordingly, we sent a Notice of Internet Availability of Proxy Materials (the “Notice”) to all of our stockholders as of the Record Date. The Notice includes instructions on how to access our proxy materials over the Internet and how to request a printed copy of these materials. Internet distribution of our proxy materials is designed to expedite receipt by stockholders, lower the cost of the Annual Meeting and conserve natural resources. However, if you would prefer to receive paper copies of our proxy materials, please follow the instructions included in the Notice.

What is the purpose of the Annual Meeting?

For stockholders to vote on the following proposals to:

| |

• | elect Michael Walrath as a Class II director to hold office until our Annual Meeting of Stockholders in 2022 and until his successor has been elected or appointed; |

| |

• | ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2020; |

| |

• | approve, on an advisory basis, the fiscal 2019 compensation of our named executive officers; |

| |

• | hold an advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officers; and |

| |

• | transact any other business that may properly come before the Annual Meeting or at any adjournment or postponement thereof. |

How does the Board of Directors recommend I vote on these proposals?

The Board recommends that you vote:

| |

• | FOR the election of Michael Walrath as a Class II director; |

| |

• | FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2020; |

| |

• | FOR the approval, on an advisory basis, of the fiscal 2019 compensation of our named executive officers; and |

| |

• | ONE YEAR, on an advisory basis, as the frequency of future advisory votes to approve the compensation of our named executive officers. |

What do I need to bring to attend and vote at the Annual Meeting?

If you plan to attend the Annual Meeting, you must be a holder of Company shares as of the Record Date. On the day of the meeting, each stockholder must bring the Notice, their proxy card, or other proof of ownership of our common stock to enter the Annual Meeting. If you are a beneficial owner and your shares are held in the name of a broker, bank or other nominee, you must bring a brokerage statement or other proof of ownership with you to the Annual Meeting.

All stockholders also must present a form of government-issued photo identification, such as a driver’s license or passport, in order to be admitted to the Annual Meeting.

Who is entitled to vote at the Annual Meeting?

Holders of Yext common stock at the close of business on the Record Date are entitled to receive the Notice and to one vote for each share of common stock at the Annual Meeting. As of the Record Date, there were 110,886,326 shares of common stock outstanding and entitled to vote at the Annual Meeting.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with Yext’s transfer agent, Broadridge Corporate Issuer Solutions, Inc., you are considered the “stockholder of record” with respect to those shares, and the Notice was sent directly to you by the Company. As a stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote in person at the Annual Meeting.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in street name. The Notice and, upon your request, the proxy materials have been forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote your shares by following their instructions for voting.

How can I vote my shares?

The instructions for accessing proxy materials and voting can be found in the Notice that you received either by mail or e-mail. In order to access proxy materials and vote, you will need the control number provided on the Notice. There are four ways a stockholder of record can vote:

(1) By Internet: You may vote over the Internet by following the instructions provided in the Notice or if you requested printed copies of proxy materials, the instructions provided in the proxy card.

(2) By Telephone: You can vote by telephone by following the instructions in the Notice or if you requested printed copies of proxy materials, the instructions provided in the proxy card.

(3) By Mail: If you requested printed copies of proxy materials, you can vote by mailing your proxy card as described in the proxy materials.

(4) In Person: If you are a stockholder as of the Record Date, you may vote in person by completing and submitting a ballot, which will be provided at the Annual Meeting. Submitting a proxy will not prevent a stockholder from attending the Annual Meeting, revoking their earlier-submitted proxy, and voting in person. You may also be represented by another person at the Annual Meeting by executing a legal proxy designating that person.

In order to be counted, proxies submitted by telephone or Internet must be received by 11:59 p.m. Eastern Time on June 12, 2019. If you vote by telephone or Internet, you do not need to return your proxy card or voting instruction card.

If you are a beneficial owner of shares held of record by a broker, bank or other nominee, you may receive a Notice or a voting instruction card from your broker, bank or other nominee. If you receive a voting instruction card from your broker, bank or other nominee, you must follow these voting instructions in order to instruct your broker, bank or other nominee on how to vote your shares. The availability of telephone or Internet voting will depend on the voting process of your broker, bank or other nominee. If you are a beneficial owner, you may not vote your shares in person at the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee.

All shares that have been properly voted and not revoked will be cast as votes at the Annual Meeting.

What happens if I decide to attend the Annual Meeting, but I have already voted or submitted a proxy covering my shares?

You may still attend the Annual Meeting. Please be aware that attendance at the Annual Meeting will not, by itself, revoke a proxy.

What can I do if I change my mind after I vote my shares?

If you are a stockholder of record, you can change your vote or revoke your proxy before it is exercised by:

| |

• | written notice of revocation to the Corporate Secretary of the Company; |

| |

• | timely delivery of a valid, later-dated proxy or a later-dated vote by telephone or via the Internet; or |

| |

• | voting in person at the Annual Meeting. |

If you are a beneficial owner of shares, you should follow the instructions of your bank, broker or other nominee to change or revoke your voting instructions.

What shares can I vote?

You can vote all shares that you owned on the Record Date. These shares include (1) shares held directly in your name as the stockholder of record, and (2) shares held for you as the beneficial owner through a broker, bank or other nominee.

Is there a list of stockholders entitled to vote at the Annual Meeting?

The names of stockholders of record entitled to vote at the Annual Meeting will be available at the Annual Meeting and for ten days prior to the Annual Meeting and can be examined by any stockholder for any purpose germane to the Annual Meeting, between the hours of 9:30 a.m. and 4:30 p.m. Eastern, at our principal executive offices at 1 Madison Avenue, 5th Floor, New York, New York 10010, by contacting the Corporate Secretary of the Company.

How are votes counted? How will abstentions and broker non-votes be treated at the Annual Meeting?

Each holder of common stock is entitled to one vote per share of common stock on each matter properly brought before the Annual Meeting.

Abstentions and broker non-votes will be considered present for purposes of determining the presence of a quorum. An abstention represents a stockholder’s affirmative choice to decline to vote on a proposal. Generally, a “broker non-vote” occurs on a matter when a broker is not permitted to vote on the matter without voting instructions from the beneficial owner and voting instructions are not given. Under the rules of the New York Stock Exchange, without voting instructions from the beneficial owners, brokers will have discretion to vote on the ratification of the appointment of our independent auditors (proposal no. 2) but not on the election of a Class II director (proposal no. 1), the advisory vote on the fiscal 2019 compensation of our named executive officers (proposal no. 3) or the advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officers (proposal no. 4). Therefore, in order for your voice to be heard, it is important that you vote. We strongly encourage you to vote - every vote is important. Please see “How many shares are required to approve the proposals being voted upon at the Annual Meeting?” below for details concerning how abstentions and broker non-votes will be counted for each proposal.

How many shares are required to approve the proposals being voted upon at the Annual Meeting?

The presence of the holders of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting, present in person or represented by proxy, is necessary to constitute a quorum. Assuming there is a proper quorum of shares represented at the Annual Meeting, the voting requirements for approval of the proposals at the Annual Meeting are as follows:

Proposal No. 1: Election of a Class II Director. The election of a Class II director requires a plurality of the voting power of the shares present or represented by proxy at the Annual Meeting and entitled to vote thereon. “Plurality” means that the individuals who receive the largest number of votes cast “for” are elected as directors. As a result, any shares not voted “for” a particular nominee (whether as a result of stockholder abstention or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on the outcome of the election. You may vote "for" or "withhold" for the nominee for election as director.

Proposal No. 2: Ratification of Appointment of Independent Auditors. The ratification of the appointment of Ernst & Young LLP requires the approval of a majority of the voting power of the shares present or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions are considered shares present and entitled to vote, and thus, will have the same effect as votes "against" the proposal. Broker non-votes are not expected to result from this proposal.

Proposal No. 3: Advisory Vote on the Fiscal 2019 Compensation of our Named Executive Officers. The advisory vote regarding named executive officer compensation requires the approval of a majority of the voting power of the shares present or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions are considered shares present and entitled to vote, and thus, will have the same effect as votes "against" the proposal. Broker non-votes will have no effect on the outcome of this proposal. Because this vote is advisory only, it will not be binding on us or on our Board. However, our Board or our compensation committee will consider the outcome of the vote when making future decisions regarding executive compensation.

Proposal No. 4: Advisory Vote on the Frequency of Future Advisory Votes to Approve the Compensation of our Named Executive Officers. The frequency of future advisory votes on executive compensation selected by stockholders will be the frequency receiving the highest number of votes from the holders of shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions and broker non-votes will have no effect on the outcome of this vote. Because this vote is advisory only, it will not be binding on us or on our Board. However, our Board or our compensation committee will consider the outcome of the vote when determining how often we should submit to stockholders an advisory vote to approve the compensation of our named executive officers.

Could other matters be decided at the Annual Meeting?

At the date of this proxy statement, we did not know of any matters to be raised at the Annual Meeting other than those referred to in this proxy statement. If other matters are properly presented at the Annual Meeting for consideration, the proxy holders named on the proxy card will have the discretion to vote on those matters for you.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Our directors, senior executives or employees, acting without special compensation, may also solicit proxies. Proxies may be solicited by personal interview, mail, electronic transmission, facsimile transmission or telephone. We are required to send copies of proxy-related materials or additional solicitation materials to brokers, fiduciaries and custodians who will forward these materials to the beneficial owners of our shares. On request, we will reimburse brokers and other persons representing beneficial owners of shares for their reasonable expenses in forwarding these materials to beneficial owners.

Who will count the vote?

Yext has designated a representative of Carideo Group Inc. as the Inspector of Election who will tabulate the votes.

How may I obtain Yext’s Form 10-K and other financial information?

Stockholders can access our annual report on Form 10-K for the fiscal year ended January 31, 2019 ("Annual Report"), which contains financial information about the Company, on the Investor Relations section of the Company’s website at investors.yext.com or on the Securities and Exchange Commission’s website at www.sec.gov. Alternatively, current and prospective investors may request a free copy of our Annual Report from:

Yext, Inc.

1 Madison Avenue, 5th Floor

New York, New York 10010

Attn: Corporate Secretary

We also will furnish any exhibit to the Annual Report if specifically requested upon payment of charges that approximate our cost of reproduction. The website addresses in this proxy statement are included for reference only. The information contained on these websites is not incorporated by reference into this proxy statement.

DIRECTORS AND CORPORATE GOVERNANCE

Board Composition

Our Board of Directors currently consists of eight members. Mr. Fernandez, a Class II director, is not standing for re-election at the Annual Meeting. Following the Annual Meeting, the size of the Board of Directors will therefore be reduced to seven members. Our directors are divided into three classes serving staggered three year terms. Upon expiration of the term of a class of directors, directors in that class will be eligible to be elected for a new three year term at the annual meeting of stockholders in the year in which their term expires. As a result of this classification of directors, it generally takes at least two annual meetings of stockholders for stockholders to effect a change in a majority of the members of our Board of Directors.

The principal occupations and certain other information about the nominee and the additional members of our Board (including the skills and qualifications that led to the conclusion that they should serve as directors), as of January 31, 2019 are set forth below.

|

| | | | | |

Name | | | Position(s) | | Age |

Nominee: | | | | |

Michael Walrath(1)(2) | | Chairman and Class II Director | | 43 |

Continuing Directors and Other: | | | | |

Howard Lerman | | Chief Executive Officer, Class I Director | | 38 |

Brian Distelburger | | President, Class I Director | | 39 |

Jesse Lipson(1) | | Class III Director | | 41 |

Julie Richardson(2)(3) | | Class I Director | | 55 |

Andrew Sheehan(2)(3) | | Class III Director | | 61 |

Tamar Yehoshua(1) | | Class III Director | | 53 |

Phillip Fernandez(3)(4) | | Class II Director | | 58 |

| |

(1) | Member of the compensation committee. |

| |

(2) | Member of the nominating and governance committee. |

| |

(3) | Member of the audit committee. |

| |

(4) | Mr. Fernandez will not be standing for re-election at the Annual Meeting. |

Nominee for Election to a Three-Year Term Ending at the 2022 Annual Meeting

Michael Walrath has served as the Chairman of our Board of Directors since March 2011 and has served as a director since November 2009. Mr. Walrath was the Founder and Chief Executive Officer of Right Media, an online advertising company, from January 2003 until its acquisition by Yahoo! in 2007. Mr. Walrath sits on the boards of directors of a number of private software and media companies. Mr. Walrath holds a B.A. in English from the University of Richmond. Our Board of Directors has determined that Mr. Walrath’s extensive experience as an entrepreneur in the technology and advertising industries, as well as his experience leading and advising high‑growth companies, makes him a qualified member of our Board of Directors.

Class I, Class III and Other Directors

Howard Lerman is our Co‑Founder and Chief Executive Officer and has also served as a member of our Board of Directors since our inception in 2006. Prior to co‑founding Yext, Mr. Lerman founded and served as a senior manager of several privately held software companies. Since 2014, Mr. Lerman has also served as Co‑Founder and Chairman of Confide, a privately held electronic messaging service. Mr. Lerman is a graduate of Thomas Jefferson High School for Science and Technology and holds a B.A. in History from Duke University. Our Board of Directors believes that Mr. Lerman’s knowledge of our Company as a Co‑Founder and as a thought leader in the digital knowledge industry allows him to make valuable contributions to the Board of Directors.

Brian Distelburger is our Co‑Founder and President and has also served as a member of our Board of Directors since our inception in 2006. Prior to co‑founding Yext, Mr. Distelburger founded and served as a senior manager of a privately held software company. From September 2012 until its sale in April 2016, Mr. Distelburger also served as chairman of the board of directors of Food Genius, Inc., a privately held food service data provider. Mr. Distelburger also serves on the Cornell Entrepreneurship Advisory Council. Mr. Distelburger holds a Bachelor’s degree from Cornell University. Our Board of Directors believes that Mr. Distelburger’s knowledge of our Company as a Co‑Founder and as a thought leader in the digital knowledge industry allows him to make valuable contributions to the Board of Directors.

Jesse Lipson has served as a director since August 2012. Mr. Lipson has served as the founder and chief executive officer of Real Magic, LLC since October 2017. From January 2016 to March 2017, Mr. Lipson served as Corporate Vice President and General Manager of Cloud Services at Citrix, a publicly held network software company. Prior to that time, Mr. Lipson was Chief Executive Officer of ShareFile, a network software company, from 2005 to 2011, when it was acquired by Citrix. Mr. Lipson held various leadership positions with Citrix between October 2011 and his appointment as Corporate Vice President and General Manager of Cloud Services in January 2016. Mr. Lipson holds a B.A. in Philosophy from Duke University. Our Board of Directors has determined that Mr. Lipson’s extensive experience as an entrepreneur in the technology industry makes him a qualified member of our Board of Directors.

Julie Richardson has served as a director since May 2015. From November 2012 to October 2014, Ms. Richardson was a Senior Adviser to Providence Equity Partners LLC, a global asset management firm. From April 2003 to November 2012, Ms. Richardson was a Partner and managing director at Providence Equity, a private equity investment fund, and oversaw its New York office. Prior to Providence Equity, Ms. Richardson served as Global Head of JP Morgan’s Telecom, Media and Technology Group, and was previously a managing director in Merrill Lynch & Co.’s investment banking group. Ms. Richardson has served on the board of directors of The Hartford Financial Group, a publicly held insurance and financial services company, since January 2014, VEREIT, a publicly held real estate investment operating property company, since April 2015, and UBS Group AG, a publicly held financial services company, since May 2017. Ms. Richardson previously served on the boards of directors of Stream Global Services, Inc. from 2009 to 2012 and Arconic from 2016 to 2018. Ms. Richardson holds a B.B.A from the University of Wisconsin‑Madison. Our Board of Directors has determined that Ms. Richardson’s financial skills and investment management and financial services experience make her a qualified member of our Board of Directors.

Andrew Sheehan has served as a director since May 2008. Mr. Sheehan has been a Partner of Sutter Hill Ventures, a venture capital firm, since 2007. Mr. Sheehan has also been the Managing Member of Tippet Venture Partners LLC, a venture capital firm, since 2014. Mr. Sheehan has served on the Board of Directors of Quinstreet, a publicly held marketing technology company, since February 2017. Mr. Sheehan also serves on the boards of directors of a number of private companies in the technology industry. Mr. Sheehan holds a B.A. in English from Dartmouth College and an MBA from the University of Pennsylvania Wharton School. Our Board of Directors has determined that Mr. Sheehan’s leadership experience, expertise as a venture capital investor and knowledge regarding the technology industry make him a qualified member of our Board of Directors.

Tamar Yehoshua has served as a director since October 2017. Ms. Yehoshua has served as chief product officer of Slack since January 2019. From 2013 to January 2019, Ms. Yehoshua served as vice president of product management at Google, Inc., and as a director of product management from 2010 to 2013. Prior to joining Google, Tamar served as vice president for advertising technology at A9, an Amazon company, from 2005 to 2010, and director of engineering from 2004 to 2005. She previously served in senior engineering leadership roles at Reasoning, Inc., a privately held application service provider specializing in software quality and modernization, from 2002 to 2004, and Noosh, Inc., a privately-held marketing services platform provider, from 1999 to 2002. Ms. Yehoshua has served on the board of directors of ServiceNow, Inc., a publicly held cloud-based digital workflow management company, since March 2019. Ms. Yehoshua also served as a member of the board of directors of RetailMeNot, Inc., an online provider of coupon services formerly listed on the NASDAQ Global Select Market, from December 2015 until its sale in May 2017 to Harland Clarke Holdings Corp. Ms. Yehoshua holds a Bachelor of Arts degree in Mathematics from the University of Pennsylvania and a Master’s degree in Computer Science from The Hebrew University of Jerusalem. Our Board of Directors has determined that Ms. Yehoshua’s extensive experience developing and managing products in the technology industry make her a qualified member of our Board of Directors.

Phillip Fernandez has served as a director since October 2016. Mr. Fernandez, a Class II director, is not standing for re-election at the Annual Meeting. We thank Mr. Fernandez for his years of service as a member of our Board of Directors and wish him well following the expiration of his term.

Director Independence

Our common stock is listed on the New York Stock Exchange, or NYSE. Under the rules of the NYSE, independent directors must comprise a majority of a listed company’s board of directors. In addition, the rules of the NYSE require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and governance committees be independent. Audit committee members must also satisfy the independence criteria set forth in Rule 10A‑3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Under the rules of the NYSE, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our Board of Directors has undertaken a review of its composition, the composition of its committees and the independence of each director. Our Board of Directors has determined that Messrs. Fernandez, Lipson, Sheehan and Walrath and Mses. Richardson and Yehoshua do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each is “independent” as that term is defined under the applicable rules and regulations of the SEC and the NYSE. Accordingly, a majority of our directors are independent, as required under applicable NYSE rules. Our audit committee, compensation committee and nominating and governance committee are each entirely comprised of independent directors. In making this determination, our Board of Directors considered the current and prior relationships that each non‑employee director has with our Company, relationships between our Company and the companies where our independent directors serve as executive officers and all other facts and circumstances our Board of Directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non‑employee director.

Board Leadership

Our Board of Directors has adopted corporate governance guidelines that provide that if the Board of Directors does not have an independent chairman, a lead independent director will be appointed by the Board of Directors. The lead independent director will be responsible for calling separate meetings of the independent directors, determining the agenda and serving as chair of meetings of independent directors, reporting to the Chief Executive Officer and Chairman of our Board of Directors regarding feedback from executive sessions, serving as spokesperson for the Company as requested, and performing such other responsibilities as may be designated by a majority of the independent directors from time to time.

Currently, the roles of Chief Executive Officer and Chairman are separate and Mr. Walrath, an independent director, serves as the Chairman of the Board of Directors. Our Board of Directors believes that having an independent director serve as the non-executive Chairman of the Board is the appropriate leadership structure for our Company at this time because it allows our Chief Executive Officer to focus on executing our Company’s business, strategic plan and managing our Company’s operations and performance, while allowing the Chairman of the Board to focus on the effectiveness of the Board of Directors and independent oversight of our senior management team and the Board.

Board Committees and Meetings

Our Board of Directors has established an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each committee are described below. Members serve on these committees until their resignation or until otherwise determined by our Board of Directors. Each of the audit, compensation, and nominating and corporate governance committees is a standing committee and operates pursuant to a separate written charter adopted by our Board of Directors that is available on the Investor Relations section of the Company’s website at investors.yext.com. The inclusion of our website address in this proxy statement does not include or incorporate by reference into this proxy statement the information on or accessible through our website.

The Board met five times during fiscal year 2019. During fiscal year 2019, each of our directors attended 75% or more of the aggregate of (a) the total number of meetings of the Board held (during the period in which the director served on

the Board) and (b) the total number of meetings held by all committees on which the director served (during the period in which the director served on such committees). Pursuant to our corporate governance guidelines, each director is encouraged to attend each annual meeting of stockholders. Four of our eight directors attended our 2018 annual meeting of stockholders.

Audit Committee

Our audit committee consists of Messrs. Fernandez and Sheehan and Ms. Richardson, with Ms. Richardson serving as chairman. Mr. Fernandez is not standing for re-election at the Annual Meeting and upon the recommendation of the nominating and corporate governance committee, the Board of Directors has appointed Michael Walrath to the audit committee effective as of immediately following the Annual Meeting. We believe that our audit committee members and Mr. Walrath meet the requirements for financial literacy under the current requirements of the Sarbanes‑Oxley Act of 2002, the NYSE listing standards and SEC rules and regulations. In addition, our Board of Directors has determined that Ms. Richardson is an audit committee financial expert within the meaning of SEC regulations. We have made this determination based on information received by our Board of Directors, including questionnaires provided by the members of our audit committee.

In order to be considered to be independent for purposes of Rule 10A‑3(b)(1) under the Exchange Act, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee: (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or (2) be an affiliated person of the listed company or any of its subsidiaries. Each member of our audit committee satisfies the independence requirements under the NYSE listing standards and Rule 10A‑3(b)(1) of the Exchange Act.

Our audit committee’s duties and responsibilities are to, among other things:

| |

• | appoint and oversee an independent registered public accounting firm and approve audit and non‑audit services; |

| |

• | evaluate the independence and qualifications of the independent registered public accounting firm at least annually; |

| |

• | review our annual audited consolidated financial statements and quarterly consolidated financial statements; |

| |

• | discuss with management the Company’s procedures with respect to earnings press releases and review financial information included in press releases and earnings guidance provided to analysts and rating agencies; |

| |

• | review the responsibilities, functions, qualifications and performance of our internal audit function, including our internal audit function’s charter, plans, budget, objectivity and the scope and results of internal audits; |

| |

• | approve the hiring, promotion, demotion or termination of the person in charge of our internal audit function; |

| |

• | review the results of the internal audit program, including significant issues in internal audit reports and responses by management; |

| |

• | review the hiring of employees or former employees of our independent registered public accounting firm if such employee will be in an accounting role or financial reporting oversight role; |

| |

• | review, approve and monitor related party transactions involving directors or executive officers and review and monitor conflicts of interest situations involving such individuals where appropriate; |

| |

• | periodically, meet separately with management, the internal auditors and our independent registered public accounting firm, both with and without management present, in each case to discuss any matters that the audit committee or others believe should be discussed privately; |

| |

• | address complaints we receive regarding accounting, internal accounting controls or auditing matters and procedures for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters; |

| |

• | review and discuss with management and our independent registered public accounting firm, on at least an annual basis, the overall adequacy and effectiveness of our legal, regulatory and ethical compliance programs, as well as reports regarding compliance with applicable laws, regulations and internal compliance programs; |

| |

• | discuss with management and our independent registered public accounting firm any correspondence with regulators or governmental agencies and any published reports that raise material issues regarding our financial statements or policies and discuss with our chief financial officer or senior legal officer any legal matters that may have a material impact on the financial statements or our compliance procedures; |

| |

• | discuss with management and, as appropriate, our independent registered public accounting firm, the adequacy and effectiveness of our policies and practices regarding information technology risk management and the internal controls related to cybersecurity; |

| |

• | oversee management’s process for identifying, monitoring and addressing enterprise risks and evaluate and discuss its assessment of such enterprise risks with management, as well as oversee and monitor management’s plans to address such risks; |

| |

• | engage independent legal, accounting and other advisors as it determines necessary or appropriate to carry out its duties; |

| |

• | report regularly to the Board of Directors about issues including, but not limited to, any issues that arise with respect to the quality or integrity of our financial statements, our compliance with legal or regulatory requirements, the performance and independence of the independent registered public accounting firm and the performance of the internal audit function; |

| |

• | review at least annually the adequacy of the committee’s charter and recommend any proposed changes to the Board of Directors for approval; and |

| |

• | conduct and present to the Board of Directors an annual self‑performance evaluation of the committee. |

Our audit committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the NYSE. Our audit committee held eleven meetings during the fiscal year 2019.

Compensation Committee

As of January 31, 2019, our compensation committee consisted of Messrs. Lipson and Walrath and Ms. Yehoshua, with Mr. Lipson serving as chairman. On March 15, 2018, the Board of Directors, upon the recommendation of the nominating and corporate governance committee, appointed Ms. Yehoshua, the newest member of the Board, to the compensation committee and changed the composition of the committee, which previously consisted of Messrs. Fernandez, Lipson and Walrath, with Mr. Fernandez serving as chairman. Each member of the compensation committee meets the requirements for independence under, and the functioning of our compensation committee complies with, any applicable requirements of the Sarbanes‑Oxley Act, the NYSE listing standards and SEC rules and regulations. Additionally, each member of the compensation committee is a “non‑employee director” as defined in Rule 16b‑3 promulgated under the Exchange Act and is an “outside director” as defined in Section 162(m) of the Internal Revenue Code of 1986, or the Code. Our compensation committee’s duties and responsibilities are to, among other things:

| |

• | establish, and periodically review, a general compensation strategy for our Company, and oversee the development and implementation of our compensation plans to ensure that these plans are consistent with this general compensation strategy; |

| |

• | administer all of our equity‑based plans and such other plans as shall be designated from time to time by the Board of Directors; |

| |

• | review, approve and determine, or make recommendations to our Board of Directors regarding, the compensation of our executive officers; |

| |

• | review and recommend to the Board of Directors the form and amount of compensation, including perquisites and other benefits, and any additional compensation to be paid, for service on the Board and Board committees and for service as a chairperson of a Board committee; |

| |

• | oversee regulatory compliance with respect to compensation matters affecting us; |

| |

• | retain or obtain the advice of compensation consultants, independent legal counsel and other advisers; |

| |

• | review and discuss with management the compensation discussion and analysis that we may be required to include in SEC filings from time to time; |

| |

• | prepare the compensation committee report on executive compensation that may be required by the SEC from time to time to be included in our annual proxy statements or annual reports on Form 10‑K filed with the SEC; |

| |

• | conduct and present to the Board of Directors an annual self‑performance evaluation of the committee; and |

| |

• | review at least annually the adequacy of the committee’s charter and recommend any proposed changes to the Board of Directors for approval. |

The compensation committee may delegate its authority to subcommittees or the chair of the compensation committee. Although the compensation committee does not currently do so, it may delegate to officers of the Company the authority to make equity grants to employees or consultants of the Company who are not directors of the Company or executive officers of the Company under the Company’s equity plans. The compensation committee has the right, in its sole discretion, to retain or obtain the advice of compensation consultants, independent legal counsel and other advisers. The compensation committee periodically engages Compensia, an outside consultant to advise on compensation-related matters. For a discussion regarding the role of management and compensation consultants in the compensation-setting process, refer to "Executive Compensation — Compensation-Setting Process."

Our compensation committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the NYSE. Our compensation committee held five meetings during the fiscal year 2019.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Messrs. Sheehan and Walrath and Ms. Richardson, with Mr. Sheehan serving as chairman. Ms. Richardson was appointed to the nominating and corporate governance committee on September 6, 2018. Each member of the nominating and corporate governance committee meets the requirements for independence under, and the functioning of our nominating and corporate governance committee complies with, any applicable requirements of the Sarbanes‑Oxley Act, the NYSE listing standards and SEC rules and regulations. Our nominating and governance committee’s duties and responsibilities are to, among other things:

| |

• | make recommendations to the Board of Directors regarding the size and structure of the board, the composition of the board, the criteria for board membership and the process for filling vacancies on the board; |

| |

• | identify individuals qualified to become board members, after taking into consideration, if applicable, the criteria for board membership and recommend to the Board of Directors nominees to fill vacancies and newly created directorships and the nominees to stand for election as directors; |

| |

• | review the duties, composition and charters of the committees of the Board of Directors; |

| |

• | review and recommend to the Board of Directors our corporate governance principles and any proposed changes to such principles; |

| |

• | conduct and present to the Board of Directors an annual self‑performance evaluation of the committee; |

| |

• | oversee the evaluation of the Board of Directors, its committees and management and report such evaluation to the Board of Directors; |

| |

• | review and approve our Code of Business Conduct and Ethics, consider questions of possible conflicts of interest of board members and other corporate officers, review actual and potential conflicts of interest of board members and corporate officers, other than related party transactions reviewed by the audit committee, and approve or prohibit any involvement of such persons in matters that may involve a conflict of interest or taking of a corporate opportunity; |

| |

• | review at least annually the adequacy of the committee’s charter and recommend any proposed changes to the Board of Directors for approval; and |

| |

• | oversee succession planning for the Board of Directors and identifying and recommending qualified individuals to become members of the Board of Directors. |

Our nominating and governance committee operates under a written charter that satisfies the applicable listing requirements and rules of the NYSE. Our nominating and governance committee held five meetings during the fiscal year 2019.

Identifying and Evaluating Director Nominees

Our Board of Directors has delegated to the nominating and governance committee the responsibility of identifying individuals qualified to become board members and recommending to the Board of Directors nominees to fill vacancies and newly created directorships and the nominees to stand for election as directors. If the nominating and governance committee determines that an additional or replacement director is required, it may take such measures that it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the committee, the Board of Directors or management. During the fiscal year ended January 31, 2019, the nominating and governance committee retained the advisory services of Heidrick & Struggles to help identify and evaluate potential nominees to recommend to the Board of Directors.

In its evaluation of director candidates, including the members of the Board of Directors eligible for reelection, the nominating and governance committee will consider the current size and composition of the Board of Directors and the needs of the Board of Directors and its committees. Some of the factors that our nominating and governance committee considers include, without limitation, character, integrity, judgment, diversity, including diversity in terms of gender, race, ethnicity and experience, independence, area of expertise, corporate experience, length of service, potential conflicts of interest, other commitments and similar factors.

Nominees must also have the highest personal and professional ethics and integrity, proven achievement and competence in the nominee’s field and the ability to exercise sound business judgment, skills that are complementary to those of the existing Board of Directors, the ability to assist and support management and make significant contributions to the Company’s success, and an understanding of the fiduciary responsibilities that are required of a member of the Board of Directors and the commitment of time and energy necessary to diligently carry out those responsibilities.

A stockholder that wants to nominate a candidate for election to the Board should direct the nomination by written notice to the Corporate Secretary and must meet the deadlines and other requirements set forth in the Company's bylaws and the rules and regulations of the SEC. See “Requirements, Including Deadlines, For Submission of Proxy Proposals, Nomination of Directors and Other Business of Stockholders” for more information. In addition, the nominating and governance committee will consider candidates recommended by stockholders in the same manner as candidates recommended to the committee from other sources. Stockholders may submit recommendations for director candidates to our General Counsel or the Legal Department, at 1 Madison Avenue, 5th Floor, New York, New York 10010. The recommendation must include the candidate’s name, home and business contact information, detailed biographical data,

relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and the Company and evidence of the recommending stockholder’s ownership of Company stock. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for Board membership.

Risk Oversight

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance, and reputational. Management is responsible for the day-to-day management of risks the Company faces, while, our Board of Directors, as a whole and assisted by its committees, has responsibility for the oversight of risk management. This oversight is conducted primarily through committees of the Board of Directors, as disclosed in the descriptions of each of the committees above and in the charters of each of the committees. The audit committee primarily oversees management’s process for identifying, monitoring and addressing enterprise risks and the adequacy and effectiveness of the Company’s policies and practices regarding information technology risk management and internal controls related to cybersecurity. The compensation committee considers the risks associated with our compensation policies and practices, with respect to all employees. All committees receive regular reports from officers responsible for oversight of particular risks within the Company. The Board periodically receives reports by each committee chair regarding the committee’s considerations and actions. The Board's allocation of risk oversight responsibility may change from time to time based on the evolving needs of the Company.

Compensation Risk Assessment

The compensation committee periodically reviews the Company’s general compensation strategy and reviews the risks arising from the Company’s compensation policies and practices for all employees that are reasonably likely to have a material adverse effect on the Company and to evaluate compensation policies and practices that could mitigate such risks. In addition, our compensation committee has engaged Compensia to independently review our executive compensation program. Based on these reviews, our compensation committee structures our executive compensation program to encourage our named executive officers focus on both short-term and long-term success. We therefore do not believe that our executive compensation program creates risks that are reasonably likely to have a material adverse effect on us.

Communications with Directors

Any communication from a stockholder to the Board of Directors generally or a particular director should be in writing and should be delivered to the General Counsel by registered or overnight mail at the principal executive office of the Company at 1 Madison Avenue, 5th Floor, New York, New York 10010. Each communication should set forth (i) the name and address of the stockholder, as it appears on the Company’s books, and if the Company’s common stock is held by a nominee, the name and address of the beneficial owner of the Company’s common stock, and (ii) the class and number of shares of the Company’s common stock that are owned of record by the record holder and beneficially by the beneficial owner.

The General Counsel will, in consultation with appropriate directors as necessary, generally screen communications from stockholders to identify communications that (i) are solicitations for products and services, (ii) relate to matters of a personal nature not relevant for the Company’s stockholders to act on or for the Board to consider or (iii) matters that are of a type that render them improper or irrelevant to the functioning of the Board of Directors or the Company.

This procedure does not apply to communications to independent directors from officers or directors of the Company who are stockholders or stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act.

Code of Business Conduct and Ethics

Our Board of Directors has adopted a Code of Business Conduct and Ethics, which establishes the standards of ethical conduct applicable to all directors, officers and employees of our Company, including our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer. The code addresses, among other things, conflicts of interest, compliance with disclosure controls and procedures and internal controls over financial reporting, corporate opportunities and confidentiality requirements. Our Code of Business Conduct and Ethics is available on the Investor Relations section of the Company’s website at investors.yext.com. We intend to disclose any amendments to the code, or any waivers of its

requirements, on our website to the extent required by SEC applicable rules and regulations. The inclusion of our website address in this proxy statement does not include or incorporate by reference into this proxy statement the information on or accessible through our website.

Corporate Governance Guidelines

Our Board of Directors has adopted corporate governance guidelines, which assists the Board in the exercise of its responsibilities. Our corporate governance guidelines are available on the Investor Relations section of the Company’s website at investors.yext.com.

Compensation Committee Interlocks

None of the members of our compensation committee is an executive officer or employee of our Company. None of our executive officers serves as a member of the compensation committee of any entity that has one or more executive officers serving on our compensation committee.

Compensation of Non-Employee Directors

The following table sets forth information concerning compensation earned by the non‑employee members of our Board of Directors in fiscal 2019. Howard Lerman, our Chief Executive Officer, and Brian Distelburger, our President, are also directors but do not receive any additional compensation for their services as a director. Information concerning the compensation earned by Mr. Lerman and Mr. Distelburger is set forth in the section titled “Executive Compensation.”

|

| | | | | | | | | | | |

Name | | | Fees Earned or

Paid in Cash | | Stock Awards

($)(1)(2) | | Total ($) |

Michael Walrath | |

| $61,250 |

| | $204,615 | |

| $265,865 |

|

Phillip Fernandez(3) | | 53,750 |

| | 204,615 | | 258,365 |

|

Jesse Lipson(3) | | 44,063 |

| | 204,615 | | 248,678 |

|

Julie Richardson(3) | | 51,513 |

| | 204,615 | | 256,128 |

|

Andrew Sheehan | | 47,500 |

| | 204,615 | | 252,115 |

|

Tamar Yehoshua(3) | | 36,563 |

| | 204,615 | | 241,178 |

|

| |

(1) | Represents the aggregate grant-date fair value of the awards as computed in accordance with FASB ASC Topic 718. Such grant-date fair value does not take into account any estimated forfeitures related to service-based vesting conditions. The assumptions used in calculating the grant-date fair value are set forth in the notes to our audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended January 31, 2019. These amounts may not correspond to the actual value that may be received by the independent directors. |

| |

(2) | All directors were granted 10,989 restricted stock units, or in the case of Mr. Walrath, restricted stock awards, on June 12, 2018. All of the shares subject to the awards shall vest on June 20, 2019, subject to the director's continued service to the Company on such date. |

| |

(3) | Fees earned reflect a pro-rated portion of the annual retainer for service as the chairman of the compensation committee, member of the compensation committee or member nominating and corporate governance committee, as applicable. |

We also reimburse our non‑employee directors for their reasonable out‑of‑pocket costs and travel expenses in connection with their attendance at Board of Directors and committee meetings.

The following table lists all outstanding options, restricted stock and restricted stock unit awards held by our non‑employee directors as of January 31, 2019:

|

| | | | | | | |

Name | | | Option Awards (#) | | Stock Awards (#) | |

Michael Walrath | | 1,572,538 |

| | 16,097 | (1) |

Phillip Fernandez | | 180,000 |

| | 28,078 | (2) |

Jesse Lipson | | — |

| | 21,834 | (3) |

Julie Richardson | | 245,000 |

| | 21,834 | (3) |

Andrew Sheehan | | — |

| | 10,989 | |

Tamar Yehoshua | | — |

| | 29,077 | (4) |

| |

(1) | The amount includes 5,108 restricted stock awards received in lieu of cash compensation. |

| |

(2) | The amount includes 4,587 unvested restricted stock units received in lieu of cash compensation and 12,502 vested but deferred restricted stock units, which will be settled on June 13, 2019, at the end of Mr. Fernandez's term as director. |

| |

(3) | The amount includes 10,845 vested but deferred restricted stock units. |

| |

(4) | The amount includes 2,936 restricted stock units received in lieu of cash compensation. |

Outside Director Compensation Policy

Members of our Board of Directors who are not employees are eligible for awards pursuant to our Outside Director Compensation Policy in the form of cash and/or equity, as described below:

Cash Compensation

Each non‑employee director is eligible to receive the following annual cash retainers for certain board and/or committee service:

| |

• | $30,000 per year for service as a member of our Board of Directors; |

| |

• | $20,000 per year additionally for service as chair of our Board of Directors; |

| |

• | $20,000 per year additionally for service as chair of the audit committee; |

| |

• | $10,000 per year additionally for service as a member of the audit committee (other than chair); |

| |

• | $15,000 per year additionally for service as chair of the compensation committee; |

| |

• | $7,500 per year additionally for service as a member of the compensation committee (other than chair); |

| |

• | $7,500 per year additionally for service as chair of the nominating and corporate governance committee; and |

| |

• | $3,750 per year additionally for service as a member of the nominating and corporate governance committee (other than chair). |

Cash retainers will be paid quarterly in arrears on a pro‑rated basis. Our non‑employee directors can elect to receive cash compensation in the form of equity awards for the upcoming calendar year. Messrs. Fernandez and Walrath and Ms. Yehoshua have elected that payment of cash retainers for the calendar year ended December 31, 2018 be made in the form of

equity awards under our 2016 Plan and therefore received restricted stock units or, in the case of Mr. Walrath, restricted stock in lieu cash for their service.

Equity Compensation

Non‑employee directors are eligible to receive all types of equity awards (except incentive stock options) under our 2016 Equity Incentive Plan, or the 2016 Plan, including discretionary awards not covered under our Outside Director Compensation Policy. All grants of awards under our Outside Director Compensation Policy will be automatic and non‑discretionary.

Upon joining our Board of Directors, each newly‑elected non‑employee director will receive an initial equity award, or the initial award, under our 2016 Plan with a value of approximately $300,000. This initial award will vest in approximately equal installments annually over a three‑year period, subject to continued service through each vesting date. The initial award will be in the form of restricted stock or restricted stock units.

On the date of each annual meeting of stockholders following the effectiveness of our Outside Director Compensation Policy, each non‑employee director who is continuing as a director following the applicable meeting will be granted an annual equity award, or the annual award, under our 2016 Plan with a value of approximately $150,000, provided the non‑employee director has served on our Board of Directors for at least the preceding six months. This annual award will vest as to 100% of the shares on the one‑year anniversary of the date of grant. A non‑employee director may defer the settlement of vested equity awards until his or her separation from our Board of Directors.

Notwithstanding the vesting schedules described above, the vesting of all equity awards granted to a non‑employee director, including any award granted outside of our Outside Director Compensation Policy, will vest in full upon a “change in control” (as defined in our 2016 Plan).

Our 2016 Plan contains maximum limits, which were approved by our stockholders, on the size of the equity awards that can be granted to each of our non‑employee directors in any fiscal year, but those maximum limits do not reflect the intended size of any potential grants or a commitment to make any equity award grants to our non‑employee directors in the future.

Indemnification

We have entered into an indemnification agreement with each of our directors and executive officers. The indemnification agreements and our certificate of incorporation and bylaws require us to indemnify our directors and executive officers to the fullest extent permitted by Delaware law. See “Certain Relationships and Related Person Transactions – Transactions and Relationships with Directors, Officers and 5% Stockholders – Indemnification of Officers and Directors.”

EXECUTIVE OFFICERS

The following table provides information concerning our named executive officers as of January 31, 2019:

|

| | | | | | |

Name | | | Position(s) | | Age |

Howard Lerman | | Chief Executive Officer, Class I Director | | 38 |

|

Brian Distelburger | | President, Class I Director | | 39 |

|

Steven Cakebread | | Chief Financial Officer | | 67 |

|

Tom Dixon | | Chief Technology Officer | | 38 |

|

James Steele | | President and Chief Revenue Officer | | 63 |

|

Information regarding Howard Lerman and Brian Distelburger, each of whom also serves as a director, is set forth above under “Directors and Corporate Governance.”

Steven Cakebread has served as our Chief Financial Officer since October 2014. Prior to joining Yext, Mr. Cakebread served in various senior executive roles, including as Chief Financial Officer and Chief Accounting Officer of D‑Wave Systems, a quantum computing company, from March 2013 to September 2014 and as Chief Financial Officer of Pandora Media Inc., a provider of personalized internet radio and music discovery service, from March 2010 to December 2012. From 2009 to March 2010, Mr. Cakebread was a Principal with J. Stevens & Co. LLC, a consulting company. From February 2009 to December 2009, Mr. Cakebread served as Senior Vice President, Chief Accounting Officer and Chief Financial Officer of Xactly Corporation, a provider of on‑demand sales performance management software. Mr. Cakebread also served as President and Chief Strategy Officer of Salesforce, a customer relationship management service provider, from March 2008 to February 2009, and as Chief Financial Officer of Salesforce from May 2002 to March 2008. He previously served as a member of the boards of directors of ServiceSource International, Inc. from 2010 to October 2017, Solar Winds from January 2008 to February 2016, Care.com from December 2013 to November 2014 and eHealth from June 2006 to June 2012. Mr. Cakebread holds a B.S. in Business from the University of California, Berkeley, and a M.B.A. from Indiana University.

Tom Dixon has served as our Chief Technology Officer since February 2017 and served as our Chief Operating Officer from February 2010 until February 2017. Prior to joining Yext, Mr. Dixon co‑founded several private software companies, including justatip.com and Intwine, and also served as the Chief Information Officer at Datran Media following its acquisition of Intwine. Mr. Dixon holds a B.A. in Philosophy from Princeton University.

James Steele has served as our President and Chief Revenue Officer since January 2017. Mr. Steele joined our Board of Directors in November 2016 and subsequently resigned from our Board of Directors in connection with his hiring in January 2017. Mr. Steele previously served as the President of InsideSales.com, a privately held provider of sales acceleration platforms, from January 2015 until January 2017. Prior to that time, from 2002 to December 2014, Mr. Steele served in various positions at Salesforce, including as the Chief Customer Officer and the President of Worldwide Sales, and before that he served in various management positions for more than 20 years at IBM, a technology and consulting company. Mr. Steele served as a member of the board of directors of Instructure, a publicly held software company, from October 2016 to May 2018 and as a member of the board of directors of IntraLinks Holdings, a publicly held software company, from September 2016 until its acquisition by Synchronoss Technologies in January 2017. Mr. Steele holds a B.S. in Civil Engineering from Bucknell University.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis provides an overview of the material components of our executive compensation program during fiscal year 2019 for:

| |

• | Howard Lerman, our Chief Executive Officer and Director; |

| |

• | Brian Distelburger, our President and Director; |

| |

• | Steven Cakebread, our Chief Financial Officer; |

| |

• | Tom Dixon, our Chief Technology Officer; and |

| |

• | James Steele, our President, Chief Revenue Officer. |

We refer to these executive officers collectively in this Compensation Discussion and Analysis and the accompanying compensation tables as our "named executive officers". The Compensation Discussion and Analysis describes our executive compensation philosophy, objectives and design, and the material terms of compensation provided to our named executive officers for fiscal 2019. This section also discusses how and why the compensation committee of the Board of Directors, or the compensation committee, arrived at specific compensation decisions involving our named executive officers, during fiscal 2019.

Executive Summary

Fiscal 2019 Financial and Business Highlights

Yext is a knowledge engine. Our platform lets businesses control their digital knowledge in the cloud and sync it to more than 150 services and applications, which we refer to as our Knowledge Network and includes Amazon Alexa, Apple Maps, Bing, Cortana, Facebook, Google, Google Assistant, Google Maps, Siri and Yelp. We have established direct data integrations with applications in our Knowledge Network that end consumers around the globe use to discover new businesses, read reviews and find accurate answers to their queries.

Highlights of Yext's financial and operational results for fiscal 2019 include:

| |

• | Increasing our revenue to $228.3 million as reported under ASC 606, or $228.8 million if reported on the basis of ASC 605 for the fiscal year ended January 31, 2019 as compared to $170.2 million in fiscal year ended January 31, 2018. |

| |

• | Driving our net loss margin to (33%) on a ASC 606 basis or (37%) on a ASC 605 basis for the fiscal year ended January 31, 2019 as compared to (39%) for the fiscal year ended January 31, 2018, which reflects a net loss of $74.8 million as reported under ASC 606, or $83.9 million if reported on the basis of ASC 605 for the fiscal year ended January 31, 2019 as compared to the $66.6 million net loss in fiscal year ended January 31, 2018. |

| |

• | Reducing our non-GAAP net loss to $30.6 million as reported under ASC 606, or $39.7 million if reported on the basis of ASC 605 for the fiscal year ended January 31, 2019 as compared to $44.2 million in the fiscal year ended January 31, 2018. |

| |

• | Increasing our operating cash flows to cash provided by operating activities of $5.2 million for the fiscal year ended January 31, 2019 as compared to cash used in operating activities of $32.4 million for the fiscal year ended January 31, 2018. |

| |

• | Hosting our third annual industry and customer event, ONWARD18, in October 2018, in New York City. |

| |

• | Announcing new global integrations with Amazon and TripAdvisor. |

| |

• | Issuing new services and features including Yext for Events, which allows businesses to centrally create, approve, publish, manage and measure events across their own digital properties, as well as on third-party sites and other local publications. |

| |

• | Being named a Great Place to Work on Fortune's list of the Top 100 Medium-Size Workplaces and to the Best Workplaces in Technology list by Fortune Magazine and Great Place to Work®. |